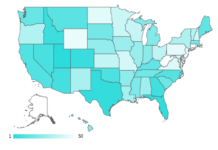

Confused as to what state and regional COVID loans might be available to you? Then check out a list of over 400 loans compiled by Best Accounting Software. The report, “US States’ Small Business Support Amid the Coronavirus Pandemic,” also analyzed and ranked the states by amount of aid available. It found:

- Idaho, Nevada, West Virginia, and Wyoming have no known loans or grants available for small businesses.

- None of the five bottom ranked states—Idaho, West Virginia, Wyoming, Delaware, and Utah—have offered tax deferrals for businesses, nor did Utah offer suspensions on commercial evictions. In West Virginia, Idaho, Wyoming, and Delaware, court orders postponed all court proceedings and deadlines, thus disabling commercial evictions.

- Only 26 states have (or have had) a statewide loan available for small businesses, with just 17 introducing grant-based schemes.

- While all states have received some federal funding in the form of Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) initiatives, some received far more support than others. For example, 25.71% of small businesses received a PPP loan in North Dakota, while just 12.19% received the same in Maryland.

- The highest percentage of small businesses to have received an EIDL loan advance within one state was 1.18% in Hawaii. The lowest was 0.56% in West Virginia.

The top five states for small business support include:

- California – Two state loans are offered to small businesses in California. The California Disaster Relief Loan Guarantee Program has been allocated $50 million and guarantees up to 95% of the loan for up to seven years. The California Capital Access Program (CalCAP) is run by the California Pollution Control Financing Authority and is targeted at small businesses that struggle to obtain financing. There are also 30 other loans available throughout cities and counties in California. Businesses were also given an extension for filing their first-quarter returns (extended to July 31, 2020) and have been given access to the Small Business Relief Payment Plans for Sales and Use Tax. From April 2, 2020, small business taxpayers—those with less than $5 million in taxable annual sales—could take advantage of a 12-month, interest-free, payment plan for up to $50,000 of sales and use tax liability only. Local governments have also been given the go-ahead to ban commercial evictions.

- Wisconsin – There are 13 local loans and grants available throughout Wisconsin, but it’s the state government’s offerings that really boost its score. An initial $5 million Small Business 20/20 Grant was launched during the early stages of the pandemic, followed by a more recent $75 million investment in the “We’re All In” schemes which are opening as we write. This includes $2,500 grants for businesses and $3,000 rental assistance grants. State legislation also prevented commercial evictions and foreclosures during the state of emergency.

- Virginia – Even though Virginia’s government hasn’t offered a statewide loan or grant for small businesses, there are 33 separate loans and grants available in the state. The most notable of these is the VA 30-Day Fund. This grant-based scheme offers up to $3,000 in forgivable loans for Virginia-based businesses that employ from three to 30 people. Businesses were also given extra time to file taxes and a court order suspends all writs of eviction during the state of emergency.

- Michigan – Michigan’s Economic Development Corporation offered five loan and grant schemes in total (two of which were limited to tech- or mobility-based companies). The Michigan Small Business Relief Program allocated $10 million to loans worth $50,000 to $200,000 and $10 million to grants worth up to $10,000. Meanwhile, the Northern Initiatives Program (allocated $2 million) gave women- and minority-owned businesses who had been impacted by the pandemic from $5,000 to $250,000 in 5-year loans. A further 14 loans/grants have been or are available within the state. The state also delayed sales and use tax payments for businesses

- Illinois – The state of Illinois offers two loan programs and also gave the hospitality industry access to a grant-based program (which has since closed). $14 million was allocated to the Hospitality Emergency Grant Program, giving businesses grants of up to $30,000. The Illinois Small Business Emergency Loan Fund provides up to $50,000 in five-year loans at an interest rate of 3% (payments are deferred for the first six months). And the Downstate Small Business Stabilization Program (allocated $20 million) offers loans of up to $25,000. There are 13 other loans available, too, and commercial evictions have been postponed with some tax release also being offered to small- to medium-sized restaurants and bars. Sales tax returns do still need filing even if payment can’t be made, however.

To view the range of loans available, listed by state, visit here.

Best Accounting Software reviews and rates financial software to help small businesses, freelancers, nonprofits and other organizations make more informed purchases.

![[VIDEO] Dickies®: Discover Workwear That’s Anything But Uniform](https://turfmagazine.com/wp-content/uploads/2023/06/1647663814-4b1a2a7742790a9b1e97a3b963477850192e1d6a9dfba9b07214a77bae25d6e3-d-218x150.jpg)

![[VIDEO] Dickies®: Discover Workwear That’s Anything But Uniform](https://turfmagazine.com/wp-content/uploads/2023/06/1647663814-4b1a2a7742790a9b1e97a3b963477850192e1d6a9dfba9b07214a77bae25d6e3-d-324x160.jpg)